It doesn’t matter how good you feel about your wealth. It’s important to protect yourself from unforeseen events. Damages and lawsuits can bleed you dry. Since the society is becoming more litigious, your assets could become a target for those looking to make a profit. You need to be more proactive about the protection of your assets. It doesn’t matter where your assets come from. It’s important to stay safe from potential threats. Here are some ways you can ensure the protection of your assets.

Re-Consider Your Retirement Plan

Did you know that your retirement plan is protected by the federal government and the state government? Moving this money into your checking and savings accounts is a great way to protect it until you use it. Keep in mind that you can’t access these funds until you’re at a certain age to avoid fees or loss of assets. Discuss the details of your retirement plan with your lawyer regarding the laws of your particular state.

Release Your Ownership if Necessary

If you feel that your assets are at risk, you should eliminate the assets altogether. It’s best to transfer the ownership of your property to a trusted individual that will provide safekeeping. You also have the option to give the asset to a trusted family member, friend, or another individual. However, there are state and tax regulations depending on the cost of the asset. You should talk to a lawyer before releasing the ownership of your property to make sure you’re doing it right.

Review Your Asset Titling

Titling is one of the ways that property is seized. Look into your asset titling and determine if it’s the title of your home or other property. This will ensure if you’re protected. Since every state has their own titling exemptions, you’ll need to determine your state laws to find the best method for your situation. The best way to protect yourself and your family when it comes the ownership of your assets.

Invest in the Right Insurance

This is one avenue that most people overlook. There are so many professions out there that require more insurance than others, but it’s important to determine your coverage. You should have an insurance plan for each of your assets. This should include automobile insurance, health insurance, homeowners insurance, and life insurance. Speak to a local lawyer who can determine your current coverage to ensure you’re protected in an unforeseen incident.

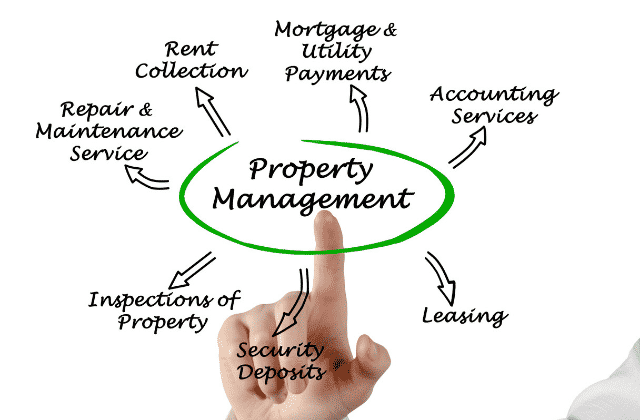

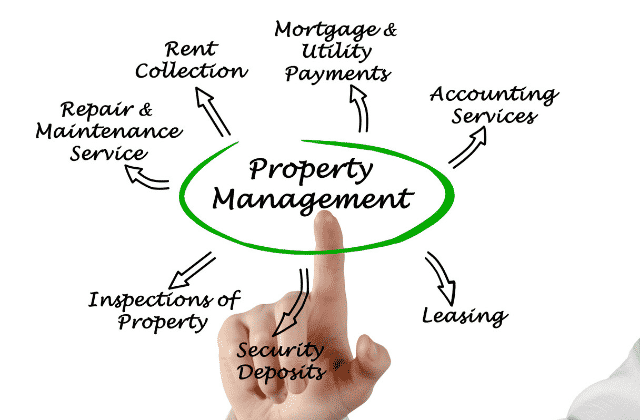

Place Your Business Assets Under a Business Entity

If you have your own business, then you need to protect it as well. Separate your business assets from your personal assets. If someone goes after your business, this can trickle into your personal assets since there’s no define separation of the two.

This means that you should form a business entity such as C-corporation, general partnership, limited liability company (LLC), limited partnership (LP), sole proprietorship, and S-corporation. It’s the right step in the formation of your business and the protection of your business. Meet with an accountant or tax professional to determine the best business entity for your particular situation.

Protecting yourself and your assets are important. You shouldn’t put off these practices. The sooner you can evaluate your situation for any strengths and weaknesses, the sooner you’ll feel protected. Talk to a trusted lawyer and study the state laws, so you can ensure that your assets are protected.

Strategic Financial Solutions can help you manage all of your assets. Debt relief is also available to individuals and businesses. This company understands the needs of its clients and dives deep into their financial hardships.